Trump’s Tax Returns Leaked by the New York Times

The New York Times recently caused a political stir by releasing information on the president’s tax reports, reporting shocking information.

Oct 24, 2020

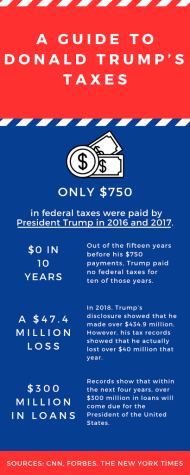

Donald Trump’s promises of releasing his tax returns, should he win the presidential election in 2016, seem like nothing but a distant memory. Although he did end up winning, he never fulfilled this promise and many moved on thinking his tax history would forever remain a mystery. A shocking revelation was made, however, on Sunday, Sept. 27 when The New York Times obtained over two decades of his tax records and released the information to the public, reporting 750 dollars in taxes paid.

One of the reasons these figures were so low is from the difference between operating income and taxable income. Operating income is what determines the worth of a real estate asset, so the higher the better. Taxable income, however, is what is reported to the Internal Revenue Service as the amount that was earned so business owners often use accountants and lawyers to deduct as much as possible by reporting expenses or losses in order to be taxed less.

By having an extremely high operating income and then working to reduce his taxable income as much as possible, the President has managed to pay the government substantially less than someone with this amount of wealth normally would. He seems to pride himself on this, as he has said in the past that not paying taxes makes him smart.

“I am not at all shocked. Trump is a businessman, not a politician, so of course he is going to do everything he can to pay as little as possible, especially when it comes to things like taxes,” senior Nicolas Cruz said.

These reports have also highlighted another interesting fact- President Trump seems to be losing a significant amount of money. His public filings from 2018 reported over four hundred million dollars in revenue. This may seem to be an impressive number, however, this figure does not equal profits. In fact, the newly revealed tax returns actually showed that he lost over 40 million dollars in the same year. It is also reported that within the next four years, over three hundred million dollars in loans that he has taken out will be due.

Trump responded to questions regarding this information being shared with the public on Tuesday night during the first presidential debate. When asked by the moderator how much he had paid in federal income taxes in 2016 and 201, he answered “millions of dollars.” This garnered criticism as the statement was proven to be completely false. Although he may have paid millions in other assorted taxes such as Medicare and social security, his federal income taxes truly amounted to 750 dollars, as his records showed, for each of those years.

“On a personal level, I have seen first hand my parents working relentlessly in order to pay their taxes every year. I even know undocumented immigrants who still pay their taxes as well. How do we elect a President, who constantly pushes the narrative of patriotism, that does not even fulfill his basic duty of paying taxes? He is an embarrassment,” sophomore Joana Ribeiro said.

Despite vows to eventually release his full tax returns, Trump has also continuously stated that being under audit would not allow him to. This is an excuse he has used since 2016, which has also been proven false. The Commander-in-Chief can release his returns, despite being under routine audits, whenever he chooses to do so. In fact, past presidents such as George W. Bush and Barack Obama released their tax returns during their time in the Oval Office. Even the IRS Commissioner himself, Charles Rettig, refuted this claim.

The release of these returns and the information they contained has so far garnered intense criticisms of the president. The meager 750 dollar amount has been compared to what an average American on a 50 thousand dollar salary paid in 2016- around five thousand dollars. The reports have also raised concerns about the transparency of elected officials. Federal income taxes are used to fund the national defense, veterans, social programs and much more. Finding out that the United States president has done less to fund these than the average citizen has certainly put a new perspective on what is expected of public officials and the leaders of this nation.