What is Bitcoin?

Bitcoin, the most popular cryptocurrency, is a little more complicated than most people even know. With safeguards and an infinite amount of computational equations, it is among the most verified/secure currency in the world.

Mar 13, 2021

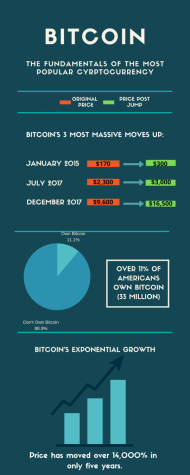

Once thought to be just a fad, the cryptocurrency Bitcoin turned into a millionaire-maker. At a current market price of around 57,000 dollars, it is up more than 14,000 percent in the last five years from a price of sound 400 dollars. Despite this massive surge in volume and price, not many people understand how bitcoin works or what it even is.

Bitcoin is the largest of a group of securities known as cryptocurrency, along with Ethereum and Litecoin. Cryptocurrency began to solve issues people had when dealing money from one person to another. These transactions required a third party system — like a bank — to validate, process and finally send payment to the receiving end. This process is slow and requires costly transaction fees. In order to resolve these issues, a system in which money could be sent through computer networks and independently verified and stored on a public history was created.

Stoshi Nakamoto is the person most credited with the creation of the first, and most popular, cryptocurrency, Bitcoin. No one has ever verified his identity however, and this is most likely a pseudonym, in order for the creator(s) to remain anonymous. Either way, Nakamoto is named on the ‘Bitcoin Whitepaper,’ which describes how this peer-to-peer network could operate, ultimately jumpstarting the creation of Bitcoin.

This paper, along with the creation of Bitcoin, came with what is known as the Blockchain. The Blockchain is essentially an irreversible database, storing all transactions into ‘blocks’ of data. As new data is input into the system, it is applied into a new block, which when filled is chained to its previous block and viewable to anyone. Every block is time stamped and placed in chronological order, setting the contained information in stone so that it cannot be altered. This keeps all transactions out of the hands of any one person or group and ensures that it instead remains decentralized in nature.

“The creation of the blockchain is an interesting system to validate and store transactions on one database that anyone can see. I expect that maybe as Bitcoin becomes even more popular, other organizations may take on that method to ensure the same level of security to their clients,” sophomore Austin Yagoda said.

A crucial part of the Blockchain’s validity is its system of equations run by a vast network of computers designed to validate all transactions. This is then placed into the Blockchain as legitimate, after these equations are solved and verified. The computers involved in this process are run by independent users known as ‘Miners.’ These independent users actively host computer servers that solve computational problems, facilitating the movement of Bitcoin in a secure manner and being rewarded themselves with Bitcoin.

Miners are given the fees in these transactions that steadily grow as the server has increasingly difficult equations to solve. Miners have needed larger server rooms and more computing power to keep up with the demand of the Blockchain’s validation process. The Blockchain is designed to increase the difficulty for two main reasons. The first is to slow, if not completely stop, any inflation rate of Bitcoin by limiting the rate at which Bitcoin is mined. The second is to make any Bitcoin transaction unhackable without the use of quantum computing, which as of now, does not exist.

The idea of a decentralized currency, one that is not identifiably governed by any particular person or group, is foreign to most since power is usually given to currency by a legitimizing organization like a corporation or country. Bitcoin, however, has been structured around a system that operates outside the jurisdiction of any one power. This means influence on Bitcoin is delegated only in the public arena, and every movement of Bitcoin is recorded on the Blockchain, for anyone who cares to observe the process.

“A decentralized currency is pretty much unheard of anywhere around the globe. It is an intriguing concept, that no one has power over it and that lack of influence may end up being a positive for the protection of assets in the form of Bitcoin in the future,” sophomore Diego Gomez said.

Depending on who is asked, Bitcoin is either the future of currency in an internationally unified way or it is a massive scam with no real future potential that will eventually crash. So far, Bitcoin has seen a continuous climb in valuation, with a projected price point of up to one million dollars per bitcoin by 2025. Whether or not Bitcoin, or cryptocurrency as a whole, will continue to thrive is yet to be seen. Historically, currency must retain trust from the public in order to be legitimate; meaning Bitcoin must maintain an illegitimate status in order to ever have a chance of continuing, its so far, exponential growth.